We began 2023 with inflation as a top concern and the Federal Reserve continuing its aggressive rate hiking cycle to get inflation back to their target range of 2%. Fortunately, the U.S. economy and equity markets have been resilient in the first half of the year despite these headwinds, which is a welcome reprieve from the sell-off experienced in 2022.

Equity and Fixed Income Markets

Equities continued to perform well in the second quarter after an unexpectedly strong first quarter of the year. All large cap equity indexes were positive for both Q1 and Q2 of 2023. Additionally, looking back over the past year, most large cap equity indices are up over 10%, with U.S. Growth up over 20% after its significant sell-off in 2022.

Emerging market equities, while positive over the past few quarters and one-year time horizon, are lagging most other areas of the market. Fixed income holdings were positive in the first quarter of 2023, but most bonds were negative in second quarter as the Federal Reserve has continued to increase the Federal Funds rate above 5%. U.S. high-yield bonds were the exception and are positive for all time frames listed below:

Did AI Kill the Bear Market?

In 2022, equity markets were down over 20% which is the accepted definition of a bear market. As discussed above, markets have made some progress in recovering from these losses. While we are not back to market highs seen in December 2021, equity markets have increased significantly from the most recent lows seen in October 2022. Much of this year’s gains have been driven by exuberance around the prospects of Artificial Intelligence (AI). While market trends come and go, the consensus seems to be that AI is potentially a longer-term theme that will help drive investment in new technologies and promote a new period of increased productivity. This is an area many investors will be monitoring for opportunities and risks in the coming years. However, this year’s AI focused market has led to a small group of companies capturing the majority of recent returns.

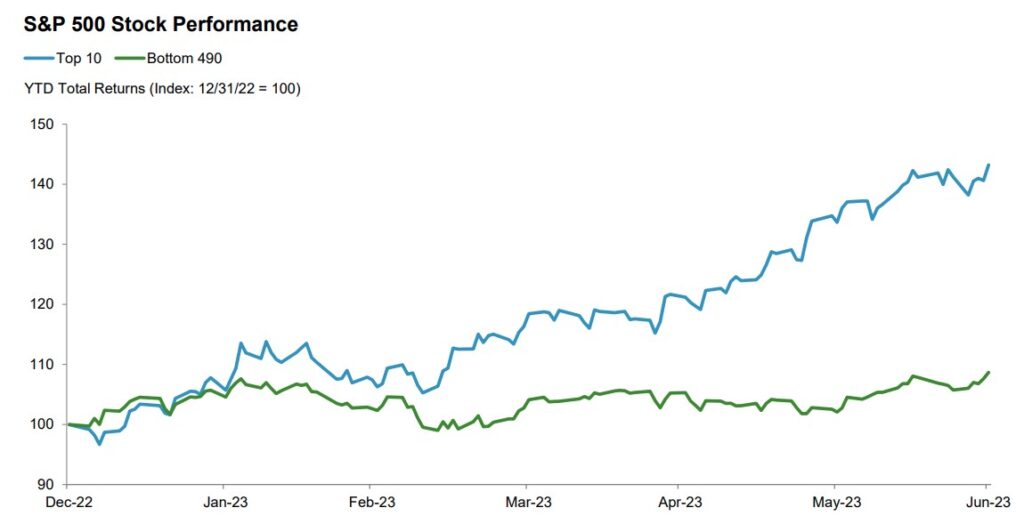

While value and international equities had strong performance in the fourth quarter 2022, according to Fidelity, stock returns in 2023 have been concentrated in the top 10 largest U.S. stocks. These companies, mostly in the technology and communications sectors, saw their values climb more than 40% due to the excitement surrounding AI. Meanwhile, the remaining 490 companies in the S&P 500 were up less than 10% over the same period:

Source: FactSet, Fidelity Investments, as of 6/30/23

What Recession?

Entering 2023, most economists were expecting a recession this year due to high inflation, rising interest rates and expected slowing growth. Despite this majority opinion, a few bank failures, and a debt-ceiling standoff in Washington, D.C., the U.S. economy has remained resilient so far this year. Additionally, recession expectations continue to be pushed further back on the calendar and the odds of avoiding recession in 2023 are increasing.

One reason for the positive turn is that U.S. consumers continue to spend at elevated rates. And spending shifted from goods and home improvement purchases during the pandemic to more spending on services in the form of concerts, travel and dining out. While these spending levels may decrease later this year as student loan repayments resume, consumer sentiment continues to be positive and increased in June1. This is partially due to inflation decreasing from 6.4% in January of this year to a lower than expected 3% in June.

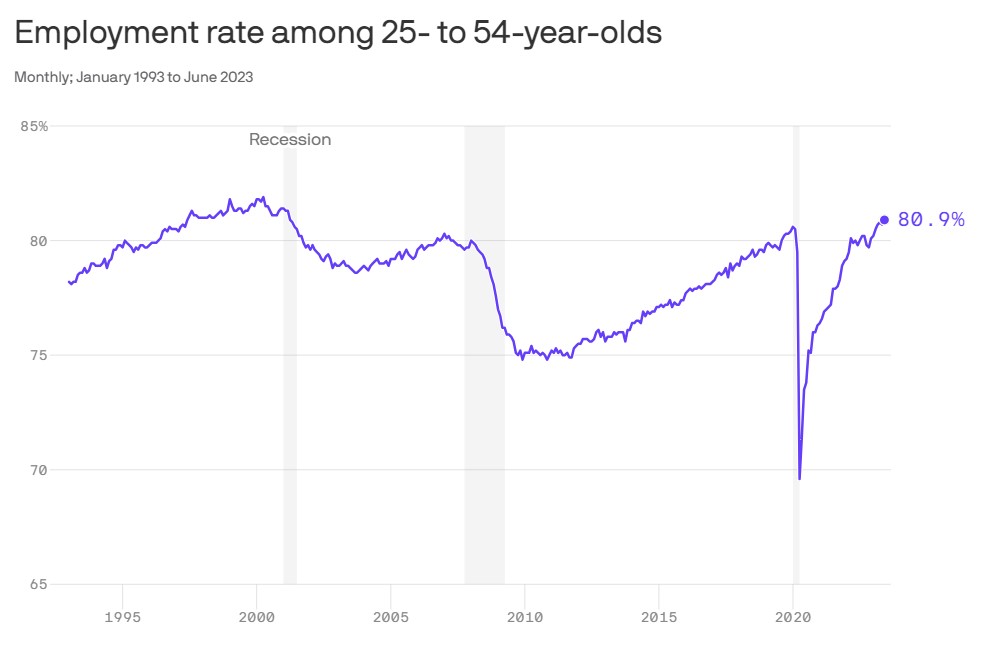

Additionally, strong employment numbers are supporting consumer spending with the latest unemployment report showing a 3.6% unemployment rate and an increase in the average workweek and average hourly earnings. The June employment report also showed that a record number (75.3%) of prime working age women were employed in June and the overall prime-age workforce is the highest since 2001. (Source: U.S. Bureau of Labor & Statistics, June 2023.)

Interest Rates May Be Nearing a Peak

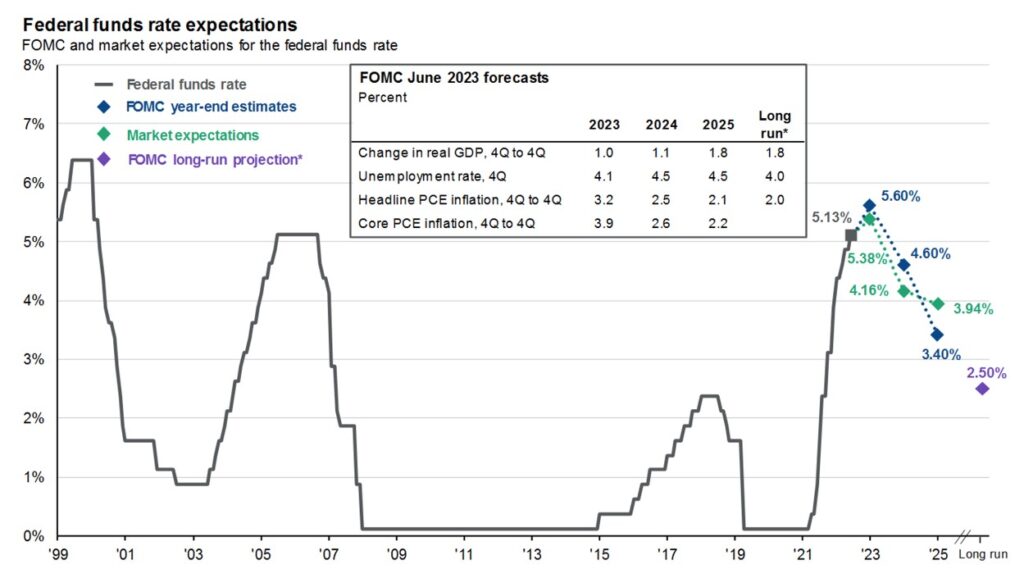

The Federal Reserve has increased interest rates by 5.0% since the beginning of 2022 to slow the economy and bring inflation back in line with historical norms. And while it may not feel like it when buying groceries, let alone shopping for a new car or home, higher interest rates are beginning to bring inflation closer to their 2% target. As a result, both the Federal Reserve and bond markets are expecting interest rates to peak in 2023. The below chart shows a peak Fed Funds rate of 5.6%, which implies two more rate hikes this year, with the expectation that interest rates will begin falling in 2024 and beyond. If interest rates do level out and begin to moderate over the next year, this could be celebrated by both capital markets and consumers.

Outlook: Can the Rally Continue?

After a difficult year for both stock and bond returns in 2022, markets have been resilient for the past three quarters regaining some but not all the losses from last year. If markets are to continue this upward trajectory, it would be helpful, if not necessary, for stocks outside the top 10 largest to participate more in this recovery. And while the valuations in technology companies like Apple, Microsoft and Nvidia have recently seen new highs, there are other areas of the U.S. and international markets that are trading below their longer-term average valuations2, potentially providing investment opportunities going forward.

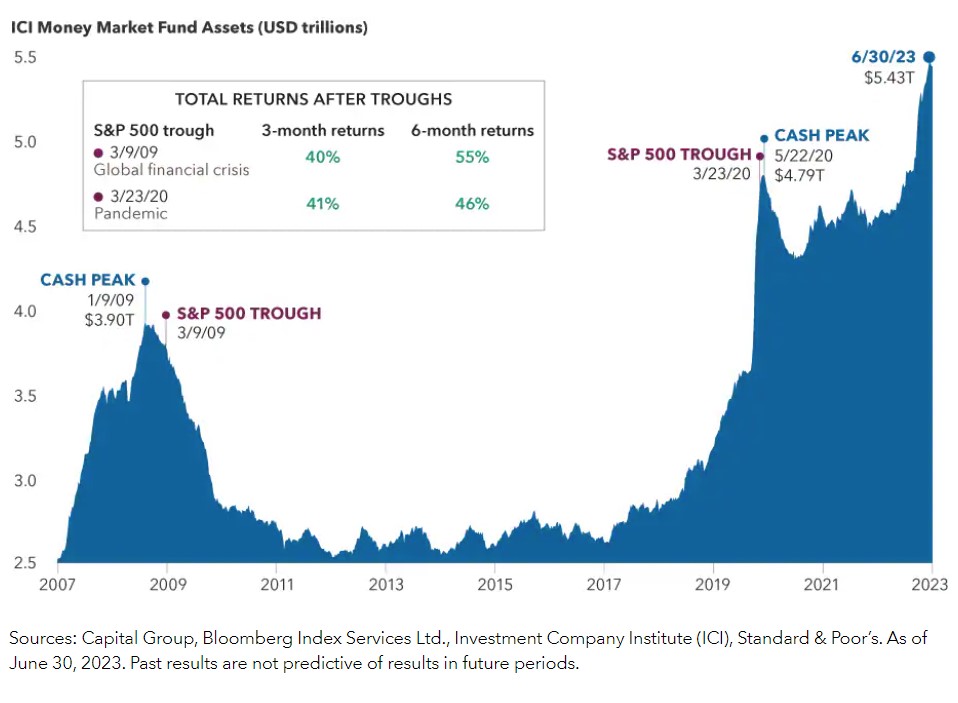

Additionally, according to Capital Group, there is a record amount of cash residing in money markets3. As of June 30, 2023, there is an estimated $5.3 trillion invested in money market funds, which is well above the pandemic cash peak of $4.79 trillion. While this makes some intuitive sense as money markets are now offering higher interest rates, some of this money may gradually be invested in equity and bond markets over the coming quarters.

While the first half of 2023 has been volatile but largely positive for investors, there is still more work to be done to fully recover from a more difficult year of returns last year. We, and the outside active managers we employ, will continue to work hard to position investment portfolios that seek to take advantage of opportunities in the capital markets and help our clients balance risk tolerances with their longer-term financial goals.

- https://www.bloomberg.com/news/articles/2023-07-14/us-consumer-sentiment-jumps-to-highest-in-nearly-two-years

- JP Morgan, Guide to the Markets, 3Q 2023 as of June 30, 2023, Pages 13 and 50.

- Sources: Capital Group, Investment Company Institute (ICI), Standard & Poor’s. As of June 30, 2023.

0 Comments