Investing in 2022 was tumultuous for almost all investors. However, investors with diversified portfolios holding value-oriented equities, shorter-term maturity bonds and some commodities avoided a degree of downside last year. So, what can we expect for 2023?

Every major asset class, except for cash and commodities, finished the year down over -10% with several parts of the market down -20% or more. The U.S. Equity Market finished the year down -19.43%, as seen in the chart below. Growth stocks finished down over -36%, while Value stocks avoided the most extreme losses seen elsewhere.

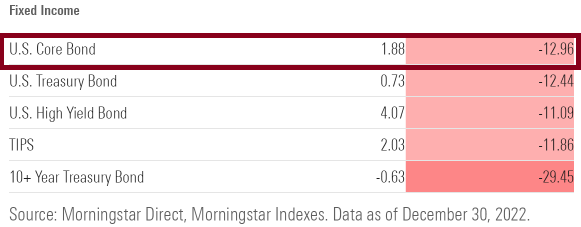

While many equity investors understand and are prepared for periods of negative returns, begrudgingly even to this degree, it bears repeating that most fixed income investors are not. The U.S. Core Bond index was down -12.96% in 2022 which was the worst year on record. The last time fixed income investors experienced a somewhat similar result was in 1979 and 1980 when the U.S. bond market was down -9.2% over a 12-month period according to Edward McQuarrie, a professor who studies historical investment returns.

To avoid a full downside impact last year, our focus was on diversifying portfolios by holding value-oriented equities, shorter maturity bonds and some commodities. Additionally, the fourth quarter brought much-needed relief to both equity and fixed income markets, but not enough to change the overall negative result for 2022:

2022 Market Performance

2022: Inflation, The Federal Reserve and Higher Interest Rates

Inflation, the Federal Reserve, and higher interest rates were main causes of loss in both stocks and bonds last year. Inflation started the year extremely high at 7.5% and increased to 9% in June due partly to the war in Ukraine. This was the highest inflation rate we have experienced since the 1980s.

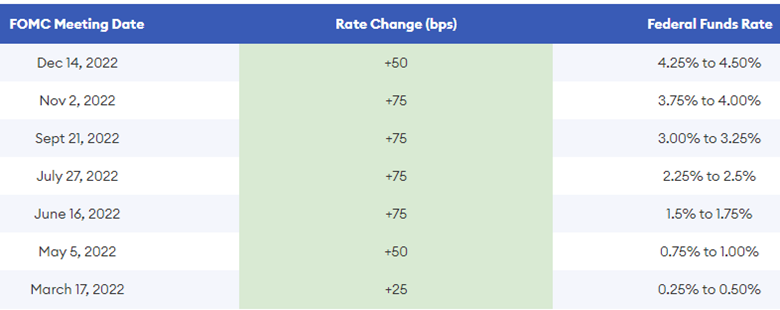

To slow the overall economy and inflation, the Federal Reserve increased interest rates aggressively throughout 2022. At the beginning of the year, the federal funds rate was near 0%, but ended the year at 4.25%. The speed of interest rate hikes during this period was exceptionally fast when compared to prior interest rate hiking cycles.

2022 Fed Rates Hikes

Source: Forbes Advisor

Investing in 2023 and Beyond

While we don’t have a crystal ball for 2023, we do have some baseline expectations for investing in this new year. On a positive note, the Federal Reserve’s efforts to slow inflation are beginning to show consistent results. Inflation as measured by the Consumer Price Index (CPI) has gone down almost every month since June and is now 6.5%. Economists also expect inflation to decrease throughout 2023*. If this better inflation news continues, the Federal Reserve may stop raising rates relatively soon.

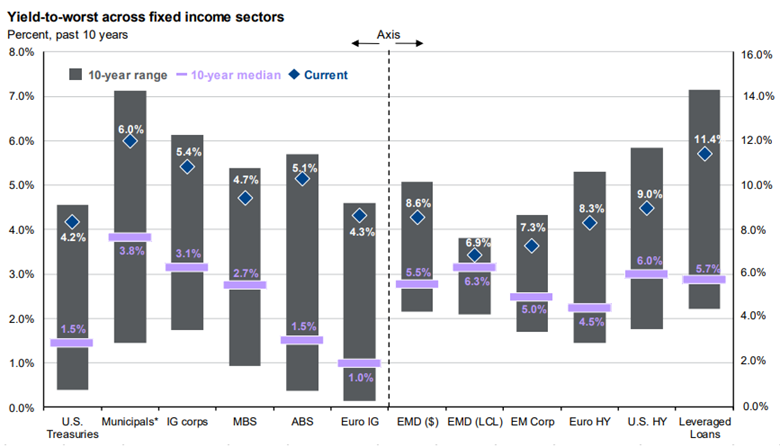

Are Bonds Back?

While bond holders saw negative returns in 2022, higher interest rates can benefit opportunistic investors. The chart below shows bonds are now offering yields of 4% or higher, the highest yields in over 10 years. As a result, fixed income assets have the potential to generate positive returns and help reduce portfolio volatility in 2023 and beyond:

Source: JP Morgan, Guide to the Markets, December 31, 2022

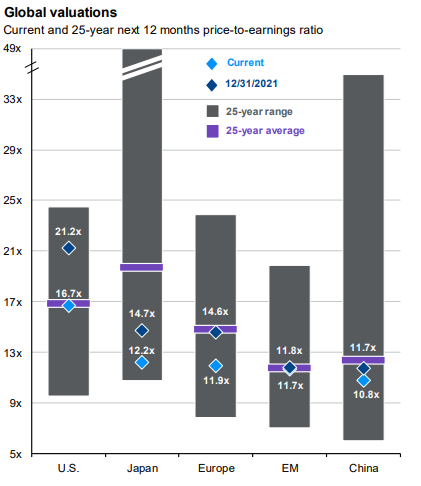

Stocks are a Better Value Now

Most market participants are expecting continued equity market volatility due to slowing growth and rising interest rates; it is even possible we see a mild recession in 2023. However, the silver lining to 2022 is that almost all equity assets categories are less expensive today when compared to this time last year. The chart below shows equities in the U.S., while not cheap, are trading near their average valuation over the past 25 years. Looking further, many international equities are trading well below their 25-year average price-to-earnings ratio, which could be beneficial to diversified investors over time:

Source: JP Morgan, Guide to the Markets, December 31, 2022

While inflation, higher interest rates and the Federal Reserve will continue to influence investment results in 2023, financial markets are consistently adjusting and looking forward. At Johnson Bixby, we too will continue looking forward, creating strong financial plans and well positioned investment portfolios that attempt to weather challenging markets and take advantage of opportunities as they develop.

* Federal Reserve Bank of Philadelphia: Fourth Quarter 2022 Survey of Professional Forecasters

0 Comments