Despite significant events in the first three months of 2023 – including two of the three largest bank failures in U.S. history – we saw stock and bond markets continue to recover from negative returns in 2022. And while market returns have been mostly positive so far this year, financial markets have remained volatile, with inflation and interest rates continuing to be major factors. Fortunately, diversified portfolios with some exposure to both Growth and Value stocks have benefited.

The year is off to a dramatic start with U.S. stocks showing resilience despite an historic banking crisis and lingering uncertainty about what’s ahead for the economy. Here’s a recap of Q1 market performance.

Equity and Fixed Income Markets

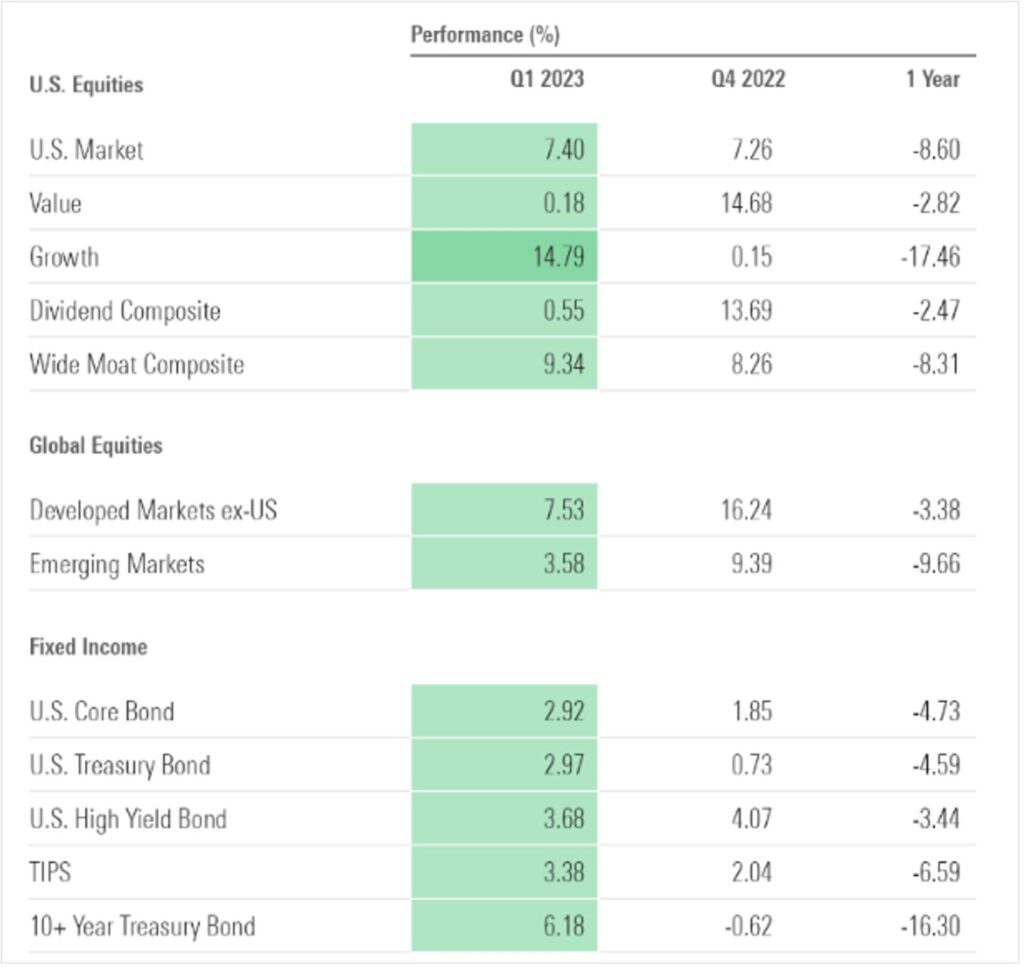

The first quarter of 2023 ended with gains in both Equity and Fixed Income markets. The U.S. Equity market finished the first three months of the year up over 7%, which is similar to the results in Q4 of 2022. However, the source of those returns was very different as the below chart details. Value stocks protected investors from more significant losses in 2022 and were up over 14% in the final quarter of last year. By comparison, Growth stocks were down to a greater degree over the past year but have been the largest source of U.S. equity market returns in 2023. Diversified portfolios with some exposure to both Growth and Value stocks benefited from these gains over the past six months.

2023 Q1 Market Performance

Global Equities, which have underperformed U.S. stocks over much of the past decade1, added to positive investment returns over the past two quarters, with Developed International markets up 16.24% in Q4 of 2022 and 7.53% in Q1 of 2023. Emerging Markets were also up 9.39% and 3.58% in each of these respective quarters. International Equities have outperformed U.S. markets beginning in early 2022 after more than a decade of lagging returns. Bonds are also contributing to positive returns after one of their worst performance years on record.

Interest Rates, Bank Failures, and Inflation

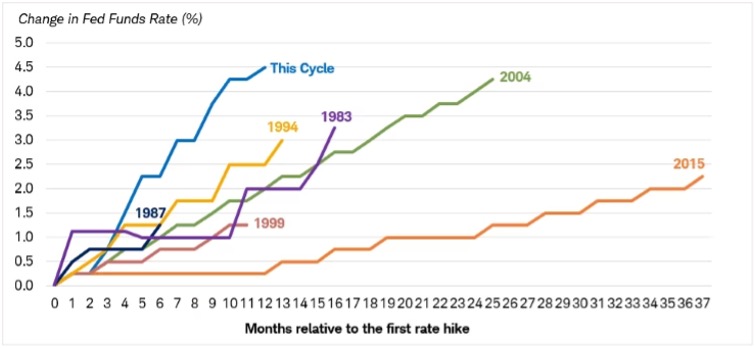

Market returns have been mostly positive in the first quarter of 2023, but there has been plenty of volatility along the way. Last year the Federal Reserve increased interest rates at the fastest pace in decades in their effort to cool the economy and bring inflation back down to acceptable levels.2

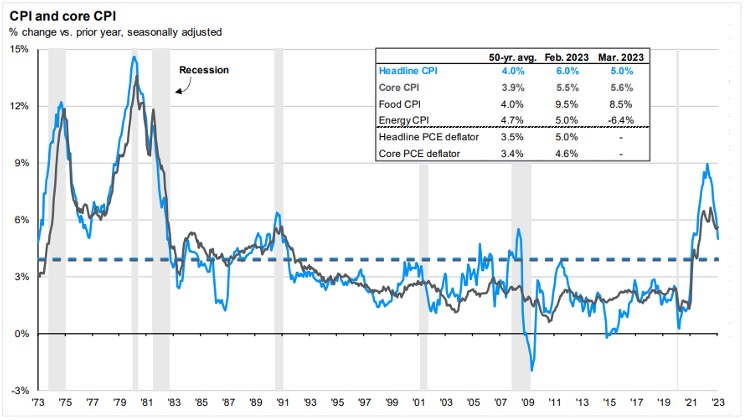

The strong start to the year for both Equities and Fixed Income is partially due to declining inflation. And, while interest rate hikes were a major factor in the recent bank failures and subsequent market volatility, they are beginning to put sustained downward pressure on consumer prices as the below chart illustrates. Inflation, as measured by the Consumer Price Index (CPI), has declined from a peak of 8.9% in June of 2022 to 5.0% in March of this year. While inflation accelerated in 2022 to levels last seen in the early 1980s, and is still elevated, the CPI has fallen for nine consecutive months. Additionally, the Federal Open Market Committee is expecting this moderation to continue throughout the remainder of 2023. 3

Due to this moderating inflation, the Federal Reserve is projecting the federal funds rate to finish 2023 at 5.1%, which is just .25% above current levels. After more than a year of rapidly rising interest rates, Equity and Fixed income markets are reacting positively to a potentially more stable interest rate environment going forward.

Outlook

While the past two quarters of positive market returns have taken some of the sting out of last year’s negativity, we continue to be cautious but optimistic going forward, as there is still more work to be done on several fronts. Inflation, while gradually falling, must continue this downward path before the Federal Reserve can stop increasing the federal funds rate. The U.S. government still needs to extend the debt ceiling at some point this year to avoid a default on government obligations. And, while financial markets are currently expecting this to eventually resolve, volatility in stock and bond markets could increase as negotiations heat up later this year. Finally, S&P 500 company earnings are expected to show slowing growth this quarter which could weigh on equity markets in the coming months.4

The concerns detailed above are good reasons to stay disciplined and maintain balanced, diversified investment portfolios. Volatility will likely continue this year as consumers and corporations further adjust to higher interest rates and debt ceilings are resolved. In the meantime, we look forward to helping clients balance risk tolerances with longer term financial goals and navigate ever-changing financial markets.

Have questions?

If you have questions about your long-term investing goals or financial planning, reach out to your financial planner for further discussion.

Sources:

1 J.P. Morgan Asset Management, Guide to the Markets 2Q 2023, March 31, 2023

https://am.jpmorgan.com/us/en/asset-management/protected/adv/insights/market-insights/guide-to-the-markets/

2 Charles Schwab, 2023 Quarterly Market Outlook: Fed on the Brink? March 30, 2023

https://www.schwab.com/learn/story/quarterly-market-outlook

3 March 22, 2023: FOMC Projections materials, accessible version

https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20230322.htm

4 FACTSET, Earnings Insight, April 6, 2023

https://insight.factset.com/topic/earnings

0 Comments