After months in and out of the headlines, the issues surrounding the debt ceiling are now front and center, as the U.S. could become unable to pay its bills as soon as June 1. There’s nothing like an impending deadline to force action. And as you know the showdown is on in Congress this week.

But what impact does a potential debt ceiling default have on investors?

A debt ceiling “crisis” is nothing new. Historically, Congress has always suspended or raised the debt limit to ensure the U.S. avoided default. But as happens frequently with divided government, Washington D.C. is currently at an impasse. Republicans in the House passed a bill that would raise the debt limit in exchange for spending cuts. Democrats, on the other hand, are looking for a bill without conditions. A deal will need to be reached where both sides make concessions.

What is a debt ceiling?

The debt ceiling is the amount of money the U.S. is authorized to borrow to pay its bills. Since the U.S. runs a budget deficit, the government is forced to borrow to make up the difference. Because Congress has the “power of the purse,” it sets spending limits and must approve any increase.

What if a deal is not reached?

The U.S. failing to pay its bills in full and on time could have serious economic repercussions. In theory, a default could result in delayed payments of federal benefits, job losses, higher borrowing costs as U.S. debt is downgraded, and a global recession. The ramifications would be hard-hitting and unprecedented, which is why it hasn’t happened before, and probably won’t this time.

Why the 14th Amendment is being considered.

The Biden Administration has been studying the idea of invoking the 14th Amendment as a potential solution. The 14th Amendment, better known for its provisions addressing citizenship and equal protection under the law, also includes this clause, which some legal scholars see as relevant to today’s showdown: “The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned.”

Default, they argue, is therefore unconstitutional and Biden would have a duty to effectively nullify the debt limit if Congress won’t raise it, so that the validity of the country’s debt isn’t questioned. While invoking the 14th Amendment may seem like an “easy” solution to some, there are no guarantees that it would make it through the courts and would likely lead to significant market volatility if pursued outside of a debt ceiling compromise.

Where do we stand now?

The X-date — the date when the government might actually default if the limit on federal borrowing is not lifted — is rapidly approaching. U.S. Treasury Secretary Janet Yellen deemed early June a hard deadline and said the odds that the U.S. can pay all its bills on June 15 are quite low without a debt ceiling increase.

What will happen if the U.S. defaults on its debts?

Of course, the worry is that the U.S. could — in the middle of a particularly nasty debt ceiling impasse — wind up in technical default on its many debt obligations, including payments to bond holders. It’s hard to predict what might happen next, but there are many who say it would roil the financial markets and jeopardize the U.S. dollar’s status as the world’s reserve currency.

The chances of a technical default — which would occur should a bond payment be missed or even delayed — are very low but not zero, according to Tom Hollenberg, a Capital Group fixed income portfolio manager.

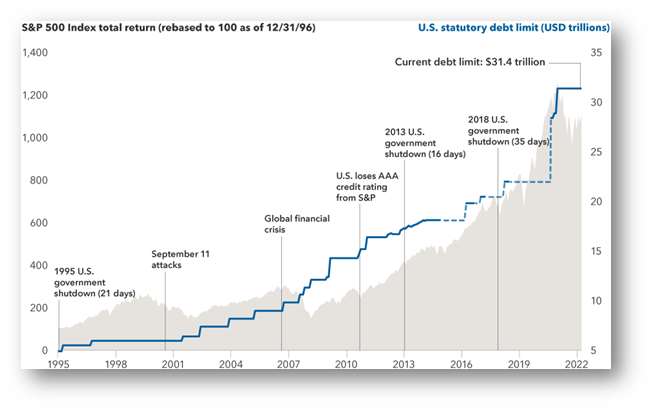

While each fiscal negotiation in Congress has unique circumstances, historically markets have ultimately powered through government standoffs as shown below:

Sources: Capital Group, Refinitiv Datastream, Standard & Poor’s, U.S. Department of the Treasury, U.S. Office of Management and Budget. Periods in which the statutory limit has been suspended are reflected by the dotted lines. These periods include February 4, 2013, through May 18, 2013; October 17, 2014, through March 31, 2017; September 30, 2017, through March 1, 2019; and August 2, 2019, through July 31, 2021. Data as of March 31, 2023. Past results are not predictive of results in future periods.

What does it mean for investors?

These events can disrupt markets for a while — sometimes even weeks or months — but if we look at history, they don’t tend to have a lasting impact on investors. That said, getting the debt ceiling issues behind us will be one less thing to worry about regarding the markets.

As always, if you have questions, please reach out to your financial planner. We’re happy to discuss this topic or others considering your long-term financial plan and goals.

Sources:

Debt Ceiling Showdown: Should Investors Worry?, Capital Group, May 2023.

What is the 14th Amendment?, Forbes, May 22, 2023.

FMG Suite, May 18, 2023.

0 Comments